FUNDS TRANSFER

If you have transferred money online and have wondered “what happens ??” after we enter details of the beneficiary in our internet/mobile banking portals and click on the ‘Submit’ button, then this article is for you.

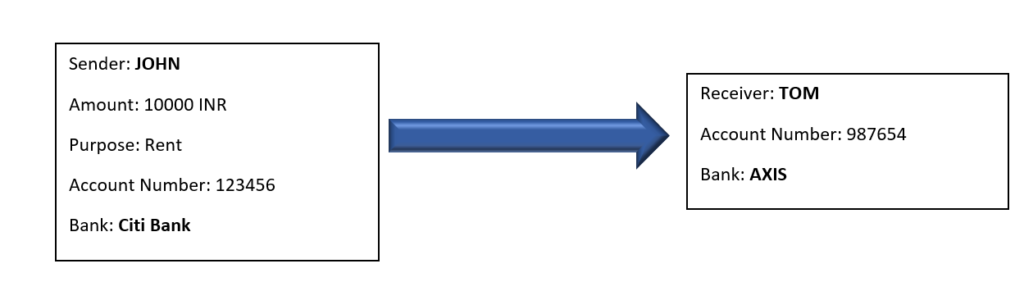

Let us take an example to easily understand money transfers,

If JOHN wants to transfer funds to TOM then John needs to know the details of Tom’s account, like his account number, name, and the bank in which the account is held (and the branch). The bank and branch details are usually used to identify the BANK code (We will get to this a little later).

What John is doing is, he is instructing his bank to take funds from his account and send it to Tom. The problem now is that TOM does not have an account in the same BANK as John.

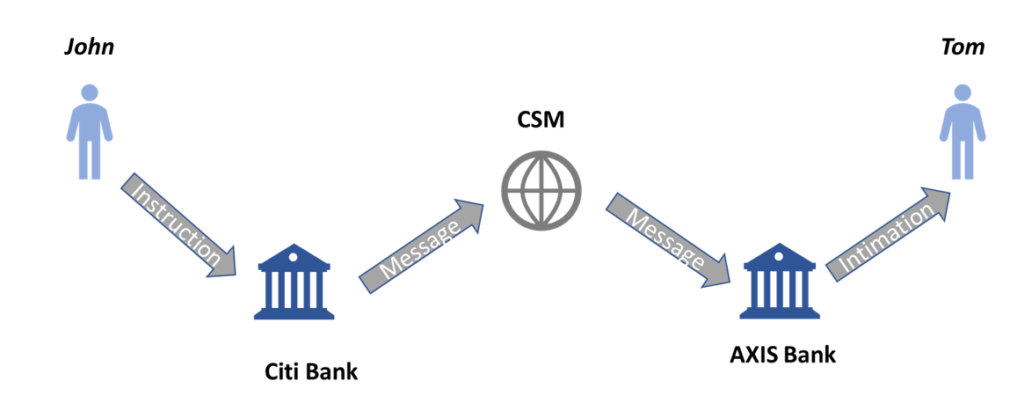

Citi bank now has to send the funds to Axis bank and ask it to credit it into TOM’s account. On a very high level, this is done by sending a message containing the payment details to Axis bank via a clearing and settlement mechanism (CSM).

After receiving the payment message, Axis bank checks if the details of the message are correct, performs a set of validations, and then credits the funds into TOM’s account.

Picture A0101:

You might have a lot of questions at this point, like

- What is a CSM?

- How the actual money is moved from bank A to B?

- What happens if TOM’s account is in the same bank or in a different country?

- What is this payment message? and how does it look like?

- What are the different types of payment messages?

- How do different types of customers send money to each other?

- How a payment received from another Bank is processed and what are the validations done?

- How does banks make money from fund transfers?

All these questions and more will be answered in the articles to follow, one question at a time. After we study the different blocks that make up a fund transfer, the above picture will get clearer.

So, to summarize, Payments messages are used to transfer funds between two accounts held in two different banks and they are the carriers of payments information.

Blog Comments

V.sasikala

May 9, 2021 at 10:04 am

Really it will be more helpful for begginers or people who got a very little knowledge of how the bank works.Bcz in this fast world we r bounded to learn things which are essential as such the money transfer,but the minute details of how it works we r not bothered bcz anything goes wrong customer care is there . They do the work for us.as such it is important to learn the basics of the network in bank so that we can be very clear and understand of what we are doing in the correct way or not. This is my opinion on this website.thankyou santosh.

Shankar Saravanappan

May 9, 2021 at 12:20 pm

Good one to start with. Awaiting further topics. Good work!

Rabi

May 9, 2021 at 1:40 pm

Really an interesting and awesome article. You have started explaining the concept amazingly by using simple words. Looking forward to read more concepts. Thank you so much.

Anand Ram Seshu

May 9, 2021 at 3:12 pm

Starters are good… Waiting for the main course…

Eurosha

May 14, 2021 at 10:31 am

A good start and neat explanation for basic understanding. Keep posting. It’s very useful content for the people who are really interested in payments to know about it.

Santosh

May 15, 2021 at 3:33 pm

Thank you

Manoj

May 9, 2021 at 7:09 pm

Very good start with basics of fund transfer, eagerly waiting for next set of courses, Thanks for this

Santosh

May 11, 2021 at 1:26 pm

Thank You

jithu

May 10, 2021 at 6:12 am

Hi Santosh,

I found this to be a good start for beginners. Looking forward to find more articles on how you help companies as BA in payments domain. what are the lesser known impactful things t be mindful of for the bank and customer etc. Good Luck!

Santosh

May 11, 2021 at 1:25 pm

Thank you

Sivakumar PR

May 11, 2021 at 2:33 am

Good start Santosh. Looking forward for future articles.

Santosh

May 15, 2021 at 3:33 pm

Thank you

Sheetal Rudrawar

May 11, 2021 at 7:13 am

Very well explained in simple words and graphics. Keep going.

Krishna Prasad N

May 16, 2021 at 7:19 am

Hi Santosh, u have the skill to simplify things and convey it an understandable manner. Keep it up and keep it going…👍🏽

Santosh

May 16, 2021 at 3:22 pm

Thanks KPN

Sourav Chanda

May 16, 2021 at 4:23 pm

Such a wonderful and concise information. I am quite a naive in the payment space and have started learning from multiple sources. Nowhere I found the concepts are written in such self-explanatory language. Looking forward to reading the next articles

Santosh

May 17, 2021 at 1:58 am

Thanks for your kind words

Srinivasan

May 17, 2021 at 7:48 am

Awesome work. Awaiting further upates.

Jayaraman

May 20, 2021 at 4:14 am

Good for Beginners!

Way of furnishing the information is good!

Ashok Patel

May 26, 2021 at 6:08 pm

This is really very good article for the beginners who want to learn banking concepts and want to be work in BFSI domain.

Santosh

May 28, 2021 at 3:26 am

Thank you

SWATI DUBEY

June 15, 2021 at 7:47 pm

Santosh , thanks alot for these informative writeups ! Very useful and easy to understand.

Archita

June 20, 2021 at 8:08 am

Hello Santosh,

Thank you for such a short and crisp explanation.

Like your earlier days, I am still working in a service based company and has a strong eager to change my field and pick up a domain specifically payments.

I fo follow you on LinkedIn as well and once again thank you for helping freshers like us in our journey to choose this path.

Will surely reach out to you if I have any query.

Santosh

June 21, 2021 at 2:34 pm

Ofcourse, sure

Keerthi

June 27, 2021 at 6:29 am

I am new to this domain and have a vague knowledge about the payment messages , really looking forward for the topics that you mentioned. Good work 👍, keep posting .

Santosh

June 27, 2021 at 8:56 am

I have written a bunch of articles after this one. Please do check them out.

Ramesh

October 8, 2021 at 11:47 am

Firstly, Thanks for providing detailed description for Fund transfer happening with 2 different banks.

I would like to understand, How the fund transfer flow will happen within same bank, Can you explain that?

(i.e) Customer A (CITI) perform IMPS to Customer B(CITI)

Santosh

October 9, 2021 at 2:13 am

There will not be any payment messages (at the interbank level). Just debit and credit of the two accounts within the same bank.

Abhaya

December 20, 2021 at 5:10 pm

Very nice content, easy to understand.