Accounting Entries in Payments

As promised in my previous article, in this one we will talk about how money moves from one party to another. Before we start, let me introduce you to a few terms that will be used throughout this article.

Debit – Money being taken from your account

Memory Aid – When you pay for something your account is debited

Credit – Money being added to your account

Memory Aid – When you receive your salary your account is credited

Let us get one more question out of our way. What are accounting entries??? It is a process of keeping track of the different credits and debits in a transaction. As a rule, you can always say that the total sum of debits should be equal to the total sum of credits.

We also need to understand 4 types of accounts that aid in the transfer of funds.

- NOSTRO

- VOSTRO

- MIRROR NOSTRO

- MIRROR CLEARING ACCOUNT (Clearing Account)

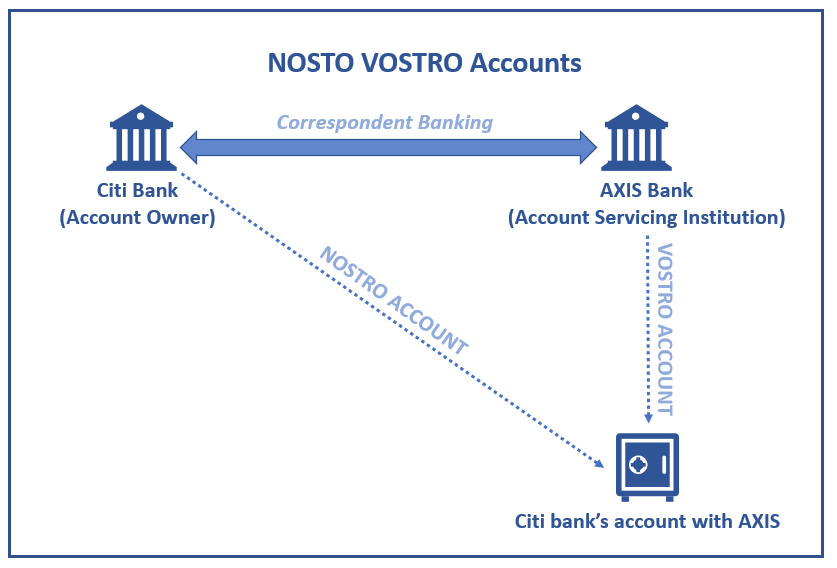

NOSTRO – Citi bank opens an account with AXIS bank (We will look at the why part in the future). From the City bank’s perspective, the account in AXIS bank is called the NOSTRO account. NOSTRO accounts are generally held in a foreign country and in the local currency of that country.

Somehow remember this, use any memory aid that you feel will do the trick. All the other 3 will fall into place. Refer Pic A0401

VOSTRO – Using the same example from above, Citi bank’s account with AXIS bank from the perspective of AXIS bank is called a VOSTRO account. So basically, the account is the same but the name changes as the perspective from which we look at the account is different. If you are a bank then another bank’s account that you hold in your books is a VOSTRO account. Refer Pic A0401

There is something else called LORO account. We will look at that later.

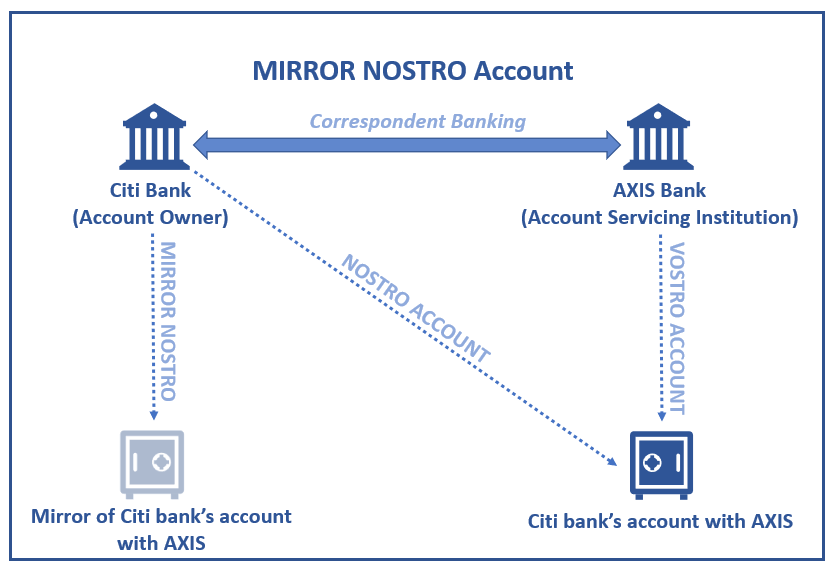

MIRROR NOSTRO – From Citi’s perspective, it has a NOSTRO account with AXIS. Now, Citi opens a mirror account of that NOSTRO in its books (In Citi bank), which acts like a mirror and nothing more. Mirror inverts left and right likewise mirror account inverts credit and debit. It is used to reflect the status/balance of the NOSTRO account. At the end of the day, the NOSTRO account is reconciled (entries matched) with MIRROR NOSTRO.

Example: If the MIRROR NOSTRO is credited then the actual NOSTRO is debited and vice versa.

You may ask “why?!!!”, The reason is simple. You will understand it if you read further.

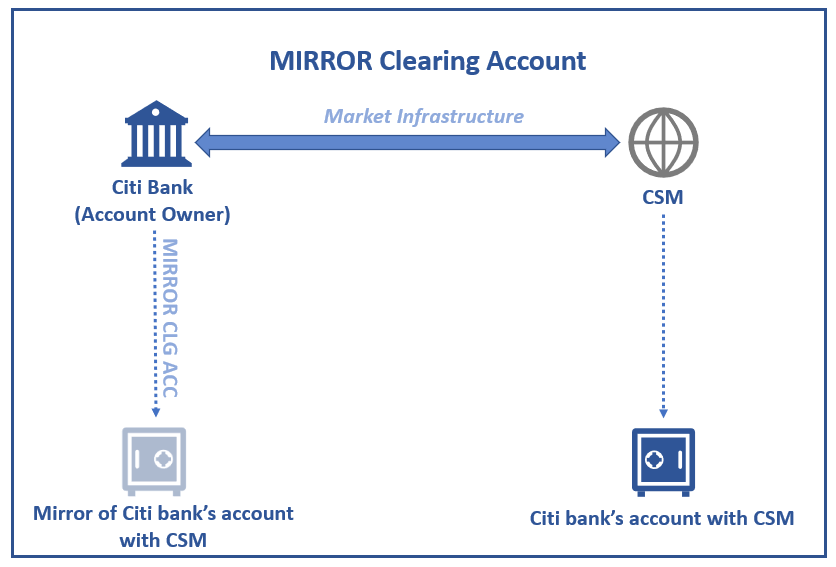

MIRROR CLEARING ACCOUNT -When banks exchange funds with each other via a CSM, then they hold an account with the CSM. It’s slightly more complex than that but for now, let us not focus on the account that we hold with CSM instead let us focus on the mirror of that CSM account that we hold in our books (or bank.) It is called the mirror clearing account.

Now that we know the different types of accounts and the associated terminologies let us start with the topic at hand. If you have only 10 mins to prepare for a payments interview, I suggest you read the following.

Correspondent Banking (Without CSM):

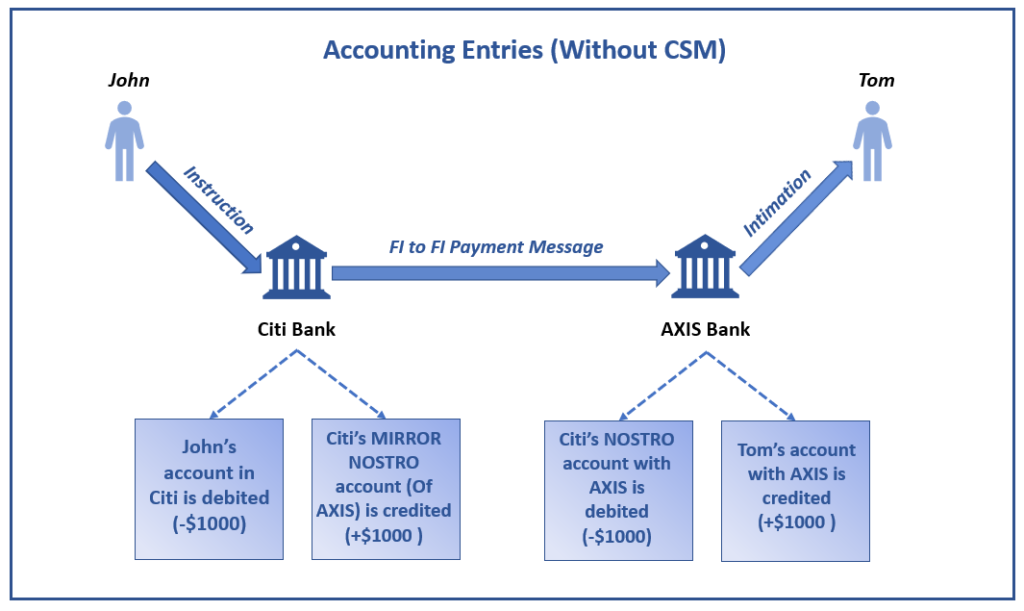

Let us take the story of John to understand the movement of money in a credit transfer. John wants to send Tom $1000 and for now, let us assume that there are no charges for this transaction.

Step 1: John instructs his bank (Citi) to send funds ($1000) from his account to Tom’s account in AXIS bank via. the internet banking portal (Or any other channel).

Step 2: Citi bank will have a “payment engine” that will receive this instruction and perform a range of checks and if all the checks result in a positive outcome, then John’s account is debited $1000.

What is this “Payment Engine”, Is it a clue about my next article??!! What are the checks that are performed?? Ok, definitely it’s the next article.

Step 3: Now the money taken from John’s account is credited into the Mirror of the NOSTRO account that Citi bank has with Axis. This is like handing over the money to AXIS bank.

Note: There will be suspense accounts involved in the transfer of funds from John’s account to the Mirror account but let us skip that here as we are trying to get the big picture.

Step 4: Now that the accounting entries within Citi bank are completed a payment message is sent by Citi bank to AXIS bank. This will be a Customer FI to FI payment message. Check out my previous articles on message types for more details.

Step 5: AXIS bank will have its payment engine and it will receive and process the payment message sent by Citi. If all the checks are successful then Citi’s NOSTRO account is debited for $1000 and the same is credited to Tom’s account.

Step 6: Tom is intimated via email or SMS or credit advice that funds have reached his account.

Yes, It’s as simple as that. This whole process can be compared to sending a money order, where you give the details of the receiver and the money to the local post office (credit to MIRROR NOSTRO) and the receiver’s city will have a post office that will provide the money to the receiver (Debit NOSTRO and credit customer).

If you are not from India or a 2K Kid then forget about this example 😊 I just hope you understand the concept. If not please reach out to me.

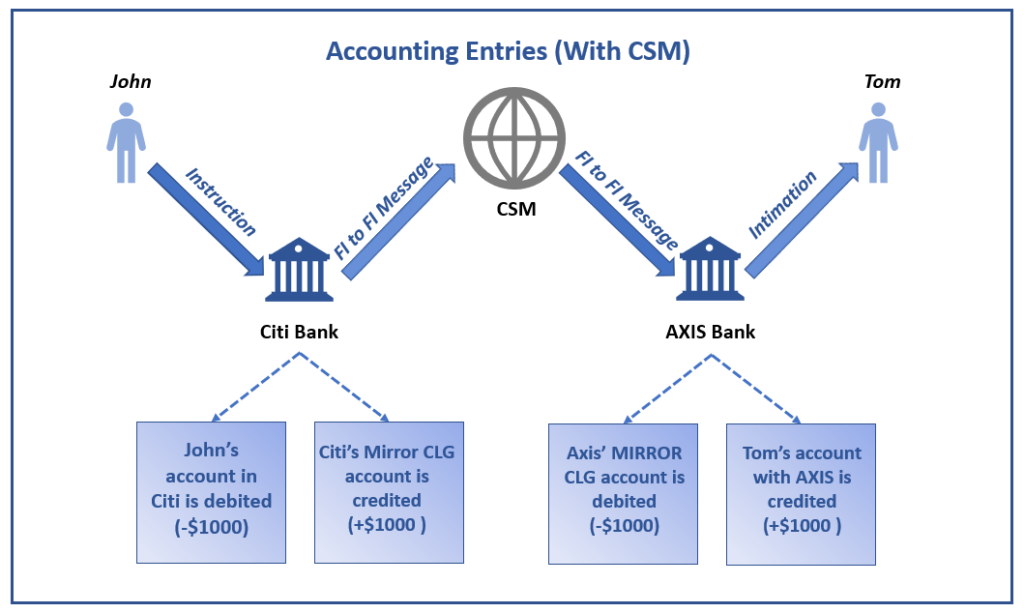

Banking Via. Market Infrastructure (With CSM):

For a similar type of transaction mentioned above if the CSM is involved then the concept is pretty much the same only difference is that the Mirror CSM account is debited and credited on both sides. Here the assumption is that the CSM is an RTGS system. In RTGS systems there is no clearing but only settlement.

If it is a NET settlement, then transactions are exchanged between parties via. Clearing and only the position of the bank’s account with CSM are calculated and at the end of the day or during INTRA day the funds are settled between the different CSM accounts of different banks. This settlement generally happens in the RTGS system.

For detailed information on clearing and settlement kindly refer to these articles from paiementor.com where it’s perfectly explained.

Clearing House: https://www.paiementor.com/clearing-and-settlement-mechanisms-multilateral-clearing/

Settlement: https://www.paiementor.com/clearing-and-settlement-mechanisms-settlement/

If I may suggest something, try to find out meaning of the terms that you do not understand in this article.

Quiz: Can you tell me what a payment market infrastructure (PMI) is???

Blog Comments

Aswini

May 30, 2021 at 3:39 am

Very useful and easy to learn

Santosh

May 30, 2021 at 10:18 am

THanks

Veeraragavan

May 30, 2021 at 6:03 am

Though I work in payment domain and used to the terms and process involved… I re-learn something or get a clarity on basic concepts. Appreciate the way you have designed the flow….

Question: In RTGS part : “If it is a NET settlement, then transactions are exchanged between parties via. Clearing and only the position of the bank’s account with CSM is calculated”.

Position of bank AC with CSM- refers to ?

Also please explain how the mirror entries are achieved …by debiting mirror account how does the funds goes to Nostro account as credit….

Santosh

May 30, 2021 at 10:27 am

In NET settlement, when a payment is processed there is no actual movement of funds between banks only the debits and credits that happen in the CSM account is noted. Position means if banks owes money or it has to receive money. I request you to read the article in the link that I have shared.

Fund does not actually go the the NOSRTO account. If a MIRROR account is credited with $100 then in the NOSTRO account you can debit $100. Money is nothing but numbers in a computer system. Hope you are able to understand.

Neeraj Kumar

May 30, 2021 at 6:06 am

CSM,Swift network etc considered as market infrastructure

Santosh

May 30, 2021 at 10:18 am

CSM is correct. To be fair my question was about payment market infra. SWIFT network is not PMI.

Neeraj Kumar

May 30, 2021 at 2:39 pm

Good initiative Santosh for all Payment enthusiasts. I want to connect with you on whtsapp or even better if we all connect Payment enthusiasts in whtsapp group to discuss payment knowledge and future opportunities.

Regards

Neeraj Singh

Saahil

May 30, 2021 at 6:20 am

Service Provider for payment like Swft,SEPA, …

Santosh

May 30, 2021 at 10:17 am

Actually Market infrastructure are entities like RTGS system, ACHs, Real time payment systems. Customers, FI swift messages not not PMI (payment market infrastructure)

Aniket

May 30, 2021 at 6:24 am

Hi Santosh,

Market Infrastructure is nothing but the all the entities which are involved in the payment transaction like Customer FI, CSM, SWIFT messages and Destination FI.

Please correct me if I am wrong.

Thanks

Aniket

Santosh

May 30, 2021 at 10:16 am

Actually Market infrastructure are entities like RTGS system, ACHs, Real time payment systems. Customers, FI swift messages not not PMI (payment market infrastructure)

uma

May 30, 2021 at 11:26 am

More informative and great article

Santosh

May 30, 2021 at 1:52 pm

Thank you

NAGARAJ SUSURLA RAMASUBBARAO

May 30, 2021 at 12:45 pm

Few things to share:

What are accounting entries??

A system of recording the financial events which results in inflow and/or outflow of money or its equivalent.

An intro to Golden Rules of Accounting could have been made.

Nostro: OUR ACCOUNT WITH YOU (CITI)

Vostro: YOUR ACCOUNT WITH US (AXIS)

Loro: THEIR ACCOUNT WITH YOU (THIRD BANK)

Example: If the MIRROR NOSTRO is credited then the actual NOSTRO is debited and vice versa.

You may ask “why?!!!”, The reason is simple. You will understand it if you read further.

Response: If you understand the golden rules of accounting, you will have better clarity of journal entries

In A0404 flow, Funding process is also involved wherein the Citi will arrange to fund the NOSTRO account with Axis by using the balance in the NOSTRO Mirror Account.

Santosh

May 30, 2021 at 1:55 pm

Hi Nagaraj.

Thank you so much for contributing. These comments will make the article even stronger.

Anand Gupta

May 30, 2021 at 1:57 pm

Well discription of Account type.. Just want to add for Loro account s… Doreign correspondents account maintained with a third Bank is referred to as LORO account ( third party account) .. example, Deutsche Bank India is looking at an account maintained by Bank of America USA with DBS Singapore in Singapore dollars.

Hope it’s correct??

Santosh

May 30, 2021 at 2:28 pm

Yes it is

Muralidhar Shenoy

May 30, 2021 at 4:31 pm

Awesome initiative Santosh.. the description is simple and the examples are perfect!

Although I’m aware of these concepts – when I am reading an article, I don’t want the current one to finish and at the end of the article I’m looking forward to the next being published.

keep up the good work!

Santosh

May 31, 2021 at 4:04 am

Thank you so much for your kind words

Shankar S

May 30, 2021 at 5:35 pm

Core topics covered with simple exams and diagrams, thanks for the article.

Santosh

May 31, 2021 at 4:03 am

Thanks for your kind words

Rajesh CP

May 31, 2021 at 3:52 am

Simple to understand. It would have been better to include the charges involved in transactions.

Rajesh CP

May 31, 2021 at 3:52 am

Simple to understand. It would have been better to include the charges involved in transactions.

Santosh

May 31, 2021 at 4:01 am

Thank you.. Point taken .. I am planning to write a separate article about charges ..

Arun

May 31, 2021 at 5:36 am

Known is always a drop. Good refresher of all the topics!! Great Job!! Happy Learning!!

Santosh

June 1, 2021 at 8:09 am

Great 🙂

Vaibhav chawla

May 31, 2021 at 9:20 pm

Market infrastructure like High value payments RTGS, low value payments ACH.

Thank you for the article

Santosh

June 1, 2021 at 8:05 am

Perfect answer

Pavan

June 2, 2021 at 1:21 am

Hi Santosh,

Is it possible to speak about liquidity/funding/de-funding the accounts held with CSM ??

Thats an interesting subnect all together..

Santosh

June 2, 2021 at 2:51 am

Sure, I am not expert in liquidity management I will take the help of someone to get this info.

Sathyamurthy

June 3, 2021 at 3:46 am

Nice document and narrated well. Will be useful for the people who want to enter into Payment field.

Santosh

June 3, 2021 at 3:53 am

Thanks

sankar

June 7, 2021 at 11:07 am

Hi,

Mirror Nostro account and VOstro account are same account?

Santosh

June 7, 2021 at 2:43 pm

Mirror NOSTRO is different from VOSTRO as it is held in a different bank but NOSTRO is the same as VOSTRO

sankar

June 7, 2021 at 11:41 am

Hi in Step-3 you have mentioned in Correspondent Bank without CSM as below

In Now the money taken from John’s account is credited into the Mirror of the NOSTRO account that Citi bank has with Axis. This is like handing over the money to AXIS bank.

But Mirror Nostro as you have explained it should be “Mirror of the NOSTRO account that CITI bank has with CITI right? Could you please clarify?

Santosh

June 7, 2021 at 2:46 pm

Mirror NOSTRO is held in CITI bank. It is the mirror of the original NOSTRO held with AXIS. Hope this clarifies your query.

Roshni

June 28, 2021 at 1:28 pm

About your question for PMI, I think CSM (NPCI, RTGS, NEFT), EuroNet (its between the bank and NPCI) in UPI system are PMIs. Hope I am correct!

Santosh

June 28, 2021 at 1:38 pm

You are absolutely correct

Sreeya

June 28, 2021 at 6:34 pm

Accounting entries are an important part or the core of the Payment Systems and you have done a great job in simplifying the things to such a great extent that any one with basic knowledge can follow.

Just one question – Aren’t the accounts used for settling the transactions, called settlement and mirror settlement accounts? Clearing accounts are used by the clearing houses to derive the final positions of all its participants. Am I correct or are the terms used interchangeably?

Pallavi

July 5, 2021 at 6:44 am

Hi Santosh,

Thanks for such a simple explanation of a crucial payments topic.

Few questions-

1.In case of banking with CSM, mirror clearing accounts are used and NOT Nostro/mirror Nostro, right?

2. Is Clearing account another term for settlement accounts or a different account?

Can you please explain the difference between both, if any?

Santosh

July 5, 2021 at 10:15 am

1. Yes

2. Settlement account is a generic term used to describe any account with which we settle funds. In this context settlement account is the account that has with the central bank.

Clearing is a private entity with which banks hold accounts that are called clearing accounts.

Gayathri

July 13, 2021 at 4:57 am

Although I have worked in other leading Industry Domains, I am new to Payments Domain and Banking. I think your page is a great start for me to learn the Business Functions. Thank you!

Santosh

July 14, 2021 at 3:41 am

Thank you

Sankara

September 15, 2021 at 11:59 am

Is Nostro and Vostro terms or accounts is specific to cross border payments or applies to domestic payments as well(Inside the same country)?

Santosh

September 15, 2021 at 12:04 pm

Generally, Nostro and Vostro accounts are used in cross-border payments and not in domestic payments

Nitin Narula

November 17, 2021 at 1:57 am

What is the role of VOSTRO account in this transaction? Doesn’t Vostro account get any entry in the whole process of transferring money.

Santosh

November 17, 2021 at 5:05 am

In this picture Citi’s Nostro account with AXIS bank is a VOSTRO account from AXIS bank’s perspective.

Dwarkadas

November 20, 2021 at 3:58 pm

Why can’t need the MIRROR VOSTRO account?

Santosh

November 20, 2021 at 7:38 pm

We would need mirror Nostro account

Rajeev

January 29, 2022 at 7:34 pm

Hi Santosh ,

Very Nice article.

qq – as I understand is that Nostro account is held in foreign currency and in the local currency of that country.

so does this mean that mirror nostro account which City Bank has also the currency of foreign currency ?? because debit credit calculation will happen when currency are same.

Santosh

February 1, 2022 at 10:46 am

Your understanding is correct