SEPA credit transfer – Introduction:

SEPA credit transfer (SCT) is a payment instrument used to execute credit transfer payments between 2 customer accounts within SEPA. SCTs are push payments, which means that the debtor initiates the payment and the funds are received by the creditor. I am confident that we all must have initiated a normal credit transfer payment in the country or region we live in. In this article, we will discuss SEPA credit transfer’s Four Corner model.

SCT is one of the 4 payment schemes in SEPA. Participation in SCT is mandatory for PSPs in the SEPA region. As an end-user, SCT enables you to send credit transfer payments with the same conditions either within the country or across national boundaries (still within SEPA) in EURO currency. SCT makes cross border payment within SEPA as easy as a domestic payment.

Some key Points about SCT:

- These are Non-Urgent low value payments

- PSPs are responsible for the services offer to their customers

- Inter PSP payment data communication is automatic and electronic

- PSPs should adhere to the message standards prescribed by EPC for inter bank communication

- Uses ISO20022 message format (Pain, Pacs & Camt)

- Used to make credit transfer payments anywhere within SEPA

- Interoperable across different PMIs in SEPA

- Payment currency is always in EURO but the debit/credit accounts need not be in EURO

Four Corner Model:

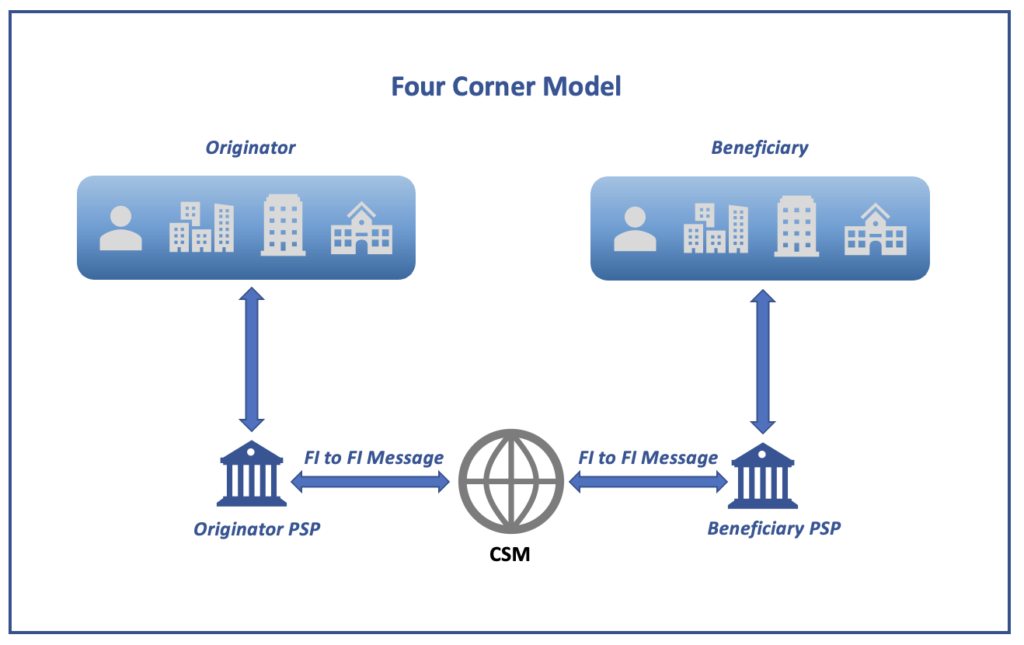

SCT operates on something called a four-corner model. There are 4 primary actors that form the corner blocks for this scheme. Hence the name 😀 They are

- Originator

- Originator PSP

- Beneficiary

- Beneficiary PSP

Detailed information on the four corner model is available in the SCT rulebook published by EPC.

Originator: Is the end customer who instructs the originating PSP to initiate a payment transaction on their behalf. In the SEPA credit transfer scheme, the originator’s account is debited hence is also the debtor. Originators may be individuals, companies, large corporated or NGOs.

Originator PSP: is the participant of the SCT scheme which receives the instruction from the Originator and initiates a credit transfer payment to the beneficiary PSP. This credit transfer payment will be in the form of a payment message (FI to FI message) . They can also recall the payment that has already been sent on behalf of the customer.

Beneficiary PSP: is the participant of the scheme who receives the payment messages from the originator PSP and credits it to the beneficiary customer. They also reject or return a payment messages that is received from the originator PSP.

Beneficiary is the end customer whose account gets credited.

No, I Did not forget the CSM. CSMs are a part of the 4 corner model but is not one of the 4 main actors. We have discussed them is many details as part of the previous article and hence moving on to other optional actors.

Intermediary PSPs: are direct participants of the CSMs offer services to the originator (Indirect participants)

Payment initiation service providers (PISP): originators make use of PISPs to initiate instruct their bank to initiate a payment. Click Here for more details

It is also important to note that the originating PSP and beneficiary PSP may be the same institution. The ordering PSP and the beneficiary PSP also share payment status updates, statements & notifications to its customers.

In the next article, we will discuss the happy flow of SCT along with the payment messages involved.

Blog Comments

badkamermeubels

August 3, 2021 at 9:13 am

Thanks.

Sankara

August 16, 2021 at 3:48 pm

1. PSPs should adhere to the message standards prescribed by EPC for inter bank communication

2. Interoperable across different PMIs in SEPA

Q: what is abbreviation of EPC & PMI’s?

Santosh

August 17, 2021 at 5:55 am

Thanks for this question .. EPC is the European payments council .. you can find more details about it in my SEPA stakeholders article

PMI is Payment market infrastructure .. More details about the same are available in the Misc payment concepts article under Intruduction tab