SEPA Credit Transfer – Payment Timelines

In the past few articles, we have seen the different payment flows that constitute the major use cases of a SEPA credit transfer scheme. In this article, we will look at the time frame within which each of the messages needs to be sent and received in order to be compliant with the SEPA credit transfer rulebook. Some of them are scheme-dictated rules and the others are a matter of practice. I have talked about the scheme dictated rules.

The most important day in all of this is the “D” day which is the day in which the payment is settled and the funds are made available to the beneficiary.

In practice, there are no rules for sending and receiving pain messages ie. In the customer to bank space. It really depends on the agreement between the bank and its customer so we will concentrate on the interbank space.

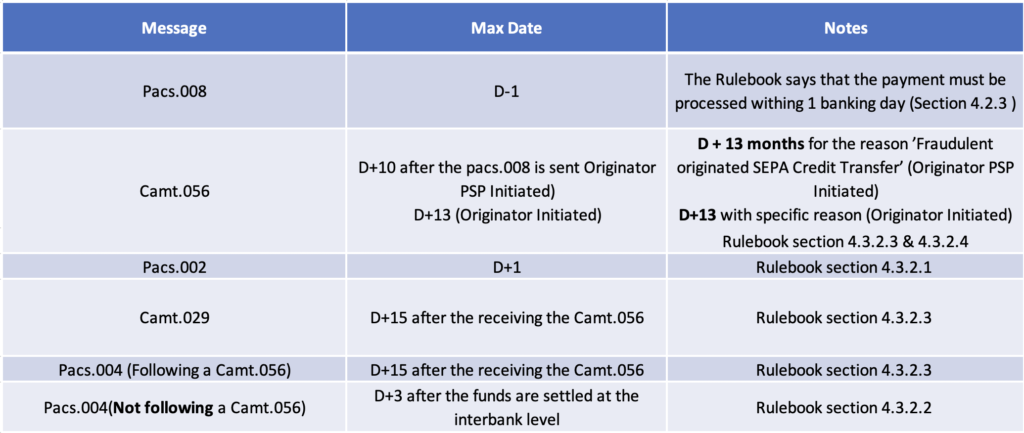

Here is a table where I have discussed the timelines within which SEPA messages have to be exchanged. For your reference, I have also added the section in the rulebook document from which you can get more details on the timelines. Link to the rulebook

I felt that a bit of explanation is needed on top of that table

All days expressed in the above table are banking business days except the 13 months which is calendar days.

Pacs.008: Since the Beneficiary bank has to processes the payment within one banking day of receiving the Pacs.008 the ordering banks can send it 1 day before D day.

All of the other messages must be sent by the corresponding party ASAP and only the Maximum days are mentioned in the table above

For the recall flow, In the exceptional case of no response from the Beneficiary PSP within the deadline of 15 Banking Business Days following the receipt of the Recall from the Originator PSP, the Originator PSP may send a Request for Status Update to the Beneficiary PSP

Blog Comments

Shreya Sen

November 24, 2021 at 6:40 pm

Hi Santosh, your posts are fabulous. I have read the whole SEPA SCT series, it has been very useful. Hoping to see further articles on SEPA Direct debit too!

Santosh

November 25, 2021 at 7:11 am

Defenitely