SWIFT MTs from a Payments Perspective

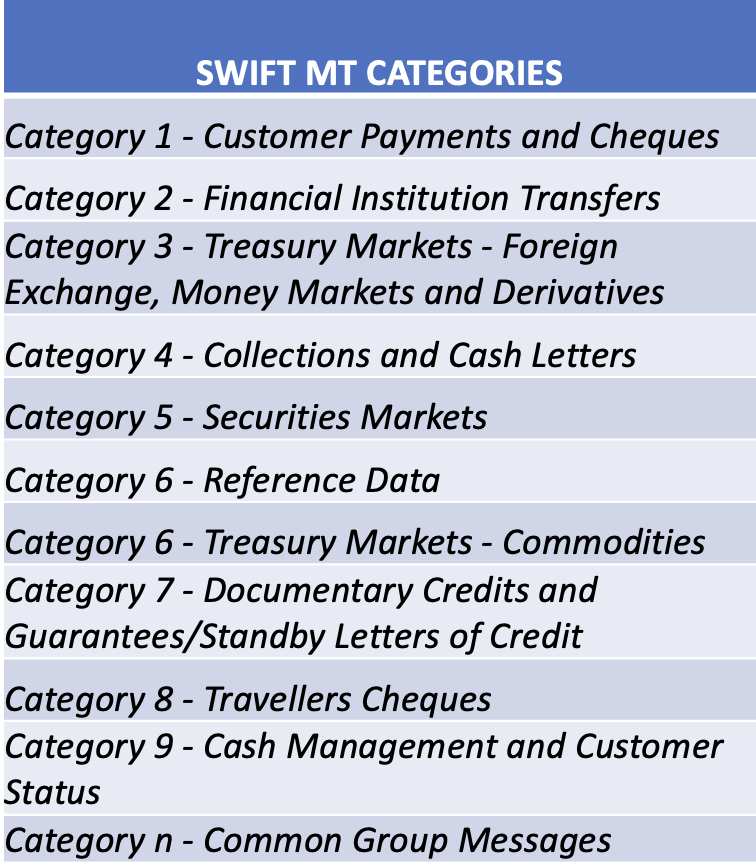

In the earlier article, we saw how we as a banking community arrived at SWIFT MT message. These MT messages have been the backbone of international finance for years now. Yes, you read it right. Finance, which included payments, Trade Finance, Treasury, FX, Securities, etc.

There are different categories of MT messages for each of the categories mentioned above. There is a total of 9 + 1 categories.

Out of all these categories of message we are going to focus on three main categories of MT messages

- Category 1 – MT1 series

- Category 2 – MT2 series

- Category 3 – MT9 series

Category 1 aka. MT1 Series:

This series of messages are used for customer ( of banks) initiated payments and checks. Messages from this category are used to initiate and transfer customer-related payments. Some examples of such messages are

- MT101 – Used by bank’s customers to initiate a payment

- MT103 – Used by banks to sends funds to each other

- MT104 – Used for Direct debit payments

- MT191 – Used for sending charge requests to other banks

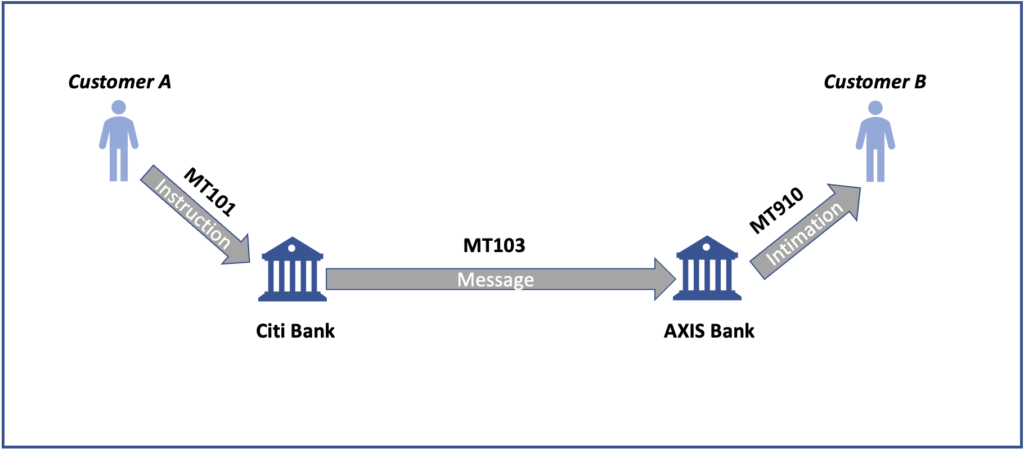

We will of course see in detail about the individual messages but just give you a better idea on this category let us take an example to understand the usage of these messages.

(Recycling old slides 😀)

Customer A (Of Citi Bank) Initiates a payment to Customer B (Of AXIS Bank) and this is done using the MT101.

Now, Citi Bank sends the funds to Axis bank using the MT103. The reason for using a 1 series message is that this transaction involves an underlying customer of the bank.

Once Axis banks credits the funds to customer B it intimates by sending an MT910. MT910s are not a part of the category 1 messages but still it is worth mentioning the same at this point.

Category 2 aka. MT2 Series:

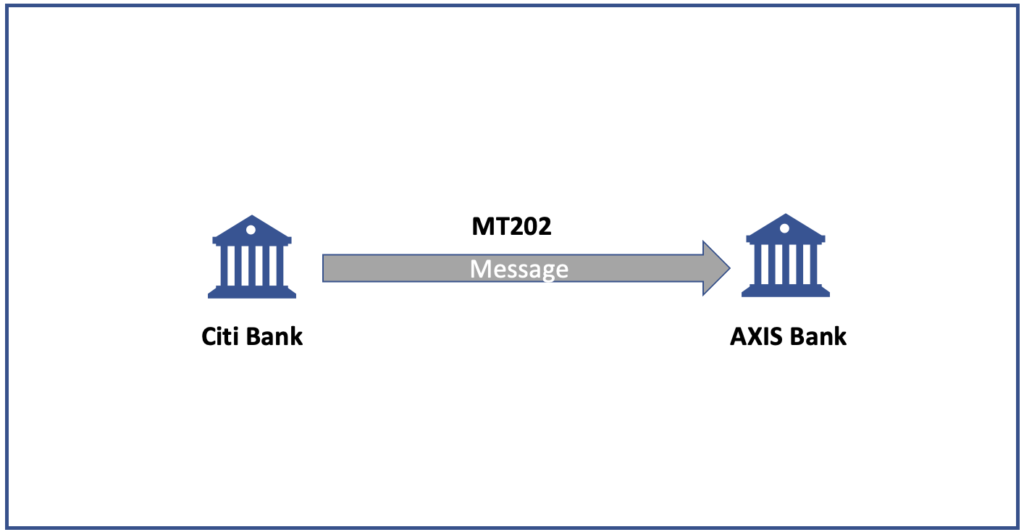

These messages are used by banks to send funds to each other. You might very well ask “What is the difference between a category 1 and 2 as both are used by banks to send funds to each other??!!”

Here is the difference, If a category 2 message is used then there should be no customers involved and all the parties in the chain must be financial institutions.

An example of such a transaction would be Citi bank sending fees to AXIS bank. Another example is to move funds between two of its accounts.

Category 9 aka. MT9 Series:

These messages do not carry funds but are used to send details of the cash position of different parties to others. More on this one later. We saw an example in the category 1 message already

These messages are used for the following purposes:

- Confirmation of debit of an account

- Conformation of credit to an account

- Account statements

- Interim status reports

And more…..

Another question you might have regarding the numbers 103, 202 .. What do they mean? Is there a logic behind the names??

There is. In the next article, we will discuss the SWIFT MT message name in Detail. Until then explore as much as you can about these messages from SWIFT’s official website.

Leave a Comment