Payment Engines:

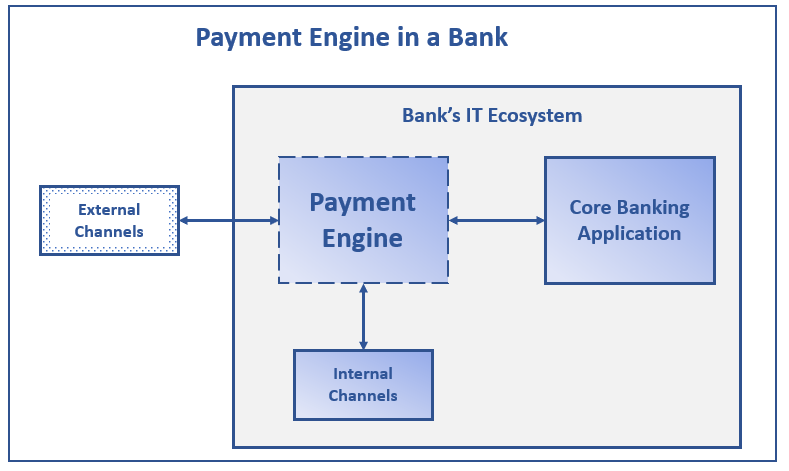

I am really excited about this topic as it’s my favorite and the one in which I have the most experience. In this article, we will be discussing a piece of software called “payment engine”. They are part of the bank’s IT ecosystem and they help banks process hundreds of thousands of payments a day seamlessly.

In the previous articles, we discussed the different message types and how banks send these messages to each other. Payment engines help banks to send, receive and process payments.

We will discuss only credit transfers here. Direct debits can be parked for the Future. We will approach this subject without any particular payment engine or message scheme in our minds. Once we get the bigger picture knowing specifics will be much easier.

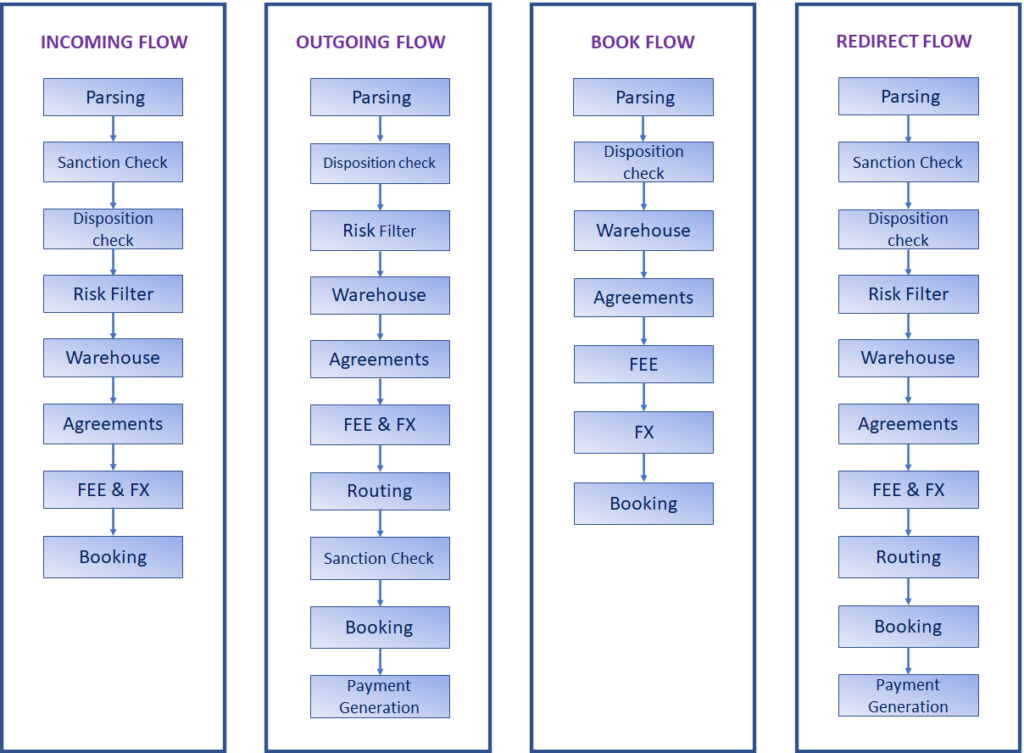

From a payment engines’ perspective there are 4 types of payments:

- Incoming

- Outgoing

- Book

- Redirect

We will briefly see what these types are and then dive right into the flows. Banks process each of these payments differently.

Incoming: If a payment is sent by another bank (aka. Counterparty) and the beneficiary customer is with our bank (from the payment engine’s perspective) then this payment is an incoming payment. Example – Payments received from SWIFT network where the beneficiary is with us.

Outgoing: The payment originates from our bank (from the payment engine’s perspective) and it has to be sent out to another bank then this payment is an outgoing payment. Example – An internet banking payment initiated by our customer to a beneficiary who has an account with a counterparty bank.

Book: Both the sender and receiver have accounts with the same bank. The funds transfer may be from a bank’s internal account to a customer’s account or from an internal account to another internal account. In any way, both the accounts are held by the same bank. Usually, there is no payment message involved for this one. Example – Payments made by your friend holding an account with the same bank 😊 Obvious example, right?!

Redirect: These are payments where neither the sender nor receiver have an account with us. As the name suggests, you just redirect the payment like a traffic cop. We will get to know why banks do that later. Let us skip example for this one (for now).

Most of the payment engines process these 4 types of payments, they call them by different names but they will fall in any one of these 4 types. What does processing even mean ?? what do the banks do?? In which order they do it ?? all these vary from one payment engine to the other but here is a very general flow. You can definitely use this for your interviews.

The boxes in the flows represent the different business processes or checks that a payment undergoes throughout its flow. For some of these processes, the payment engine sends a request to external systems and proceeds with the next process based on the response.

Remember, the main goal of these payment engines is to increase the Straight Through Processing (STP) rate. It means the number of payments that are processed automatically without any human intervention. Lesser human intervention means cost-saving and high accuracy.

If any of these checks fail then in most cases the payment will fall in a repair queue where a user manually corrects the payment and forces the payment to move forward. Here is a detailed explanation of what those different processes mean.

Parsing – Incoming messages (Customer to FI or FI to FI) are split into their individual components and the business data from the payment is extracted by the system and stored. This data is then used for further processing of payment.

Sanction Check – Countries like the US impose sanctions on other countries and if the payment is sent to one of those sanctioned countries, then the payment will be stopped. During this process, the message is also checked if it has been sent for illegal activities like money laundering these are AML (Anti Money Laundering) checks. AMLs are either combined with sanctions checks or done separately. Payment engines usually contact external systems to perform these checks.

Disposition Check – Firstly the debit and credit accounts are determined and then checks are performed on these accounts to identify if they are valid and not closed or blocked. The payment engine also checks if the debit account contains sufficient balance for that transaction. If the balance is available then the funds are reserved (locked) so that other payments cannot use that amount.

Reservation is also performed individually at a later stage in certain payment engines (PEs). For performing disposition checks PEs interact with an application called CORE banking application where the account details are stored.

Risk Filter –This is a feature provided by certain PEs where parameters that define risky payments are configured. If a payment matches these criteria, then the payment is flagged and sent for manual authorization.

Warehouse – If a future dated payment is received by a payment engine, then it is stored in the payment warehouse. On the processing date, the payment is released from the warehouse to continue further processing. Some customers send payments to the bank and ask it to execute or process them at a later date.

Agreements – These are service level agreements that the bank has with its customers. If a customer has a particular agreement that gets him a special FX rate, then it is applied to the payment at this stage. Based on the agreement applied, the flow of the payment may deviate from the normal flow.

FEE & FX – Here the fee for the payment on the credit and debit sides is applied. If there is a currency conversion required for this payment then the correct FX rate is chosen by the system and applied to the payment.

If a payment is in USD and the debit account is in INR then USD is converted to INR and the INR amount is arrived at. This will be used during booking. If the account is in INR, then you can debit it only in INR. Bank’s treasury system feeds the rates to the payment engine at regular intervals. My next article is about FEE and FX where will see about it in detail.

Routing – This process is mostly applied for Outgoing and Re-Direct payments. Here the next party to which the payment must be sent and the mode in which it must be sent is identified. The modes can be discussed later. For now, we can just understand that the payment’s next destination will be identified here.

Booking – This is one of the most important processes where the request to debit and credit the different accounts are sent by the payment system to the Ledger (A kind of digital diary where accounting entries are maintained). The core banking system replies with a positive or negative acknowledgment based on which further processing is done.

Payment Generation – The name must have given you an idea of what it does. Payments are generated by the payment system in accordance with the message formats and are sent out.

The end!!!!!!!!!! Ha Ha 😊 not so soon. There are 3 more things that we need to talk about.

Duplicate Check – In all these 4 flows system tries to detect if it is a duplicate payment based on predefined payment criteria like amount and message reference. if it is a duplicate then based on the configuration it is sent to repair or processed further.

Repair – If any of the above checks fail then the payment falls in a repair queue. Bank’s employees will monitor this queue and if a payment falls in repair, then they try to repair it or approve it or reject it. This is purely a business decision.

4EV – Most PEs have this feature where if a payment is manually edited or inputted then it has to be authorized by another person (4 eyes are involved) you get it?? 😊 This is just a safety precaution to recheck the work of the person who repairs the payment.

There are so many additional features that each payment engine offers which we do not have time to get into in this article but this is the basis of any payment processing flow. The type of payment is decided by the system and the corresponding flow is invoked.

Examples of some popular payment engines and their companies – GPP (Finastra), OPF (FIS), B@NCS (TCS), TPH (Temenos), Volpay (Volante) & EPP (Fiserv)

Quiz:

- How are payment engines linked to the payment communication networks like SWIFT?

- What technology is your payment engine built on? (The one in which you work or worked)

- You need not name the payment engine but can you tell any additional features that it has?

Blog Comments

Krishna Prasad N

June 6, 2021 at 5:06 am

Quite helpful 👍🏽

Chaitanya kumar g c

June 6, 2021 at 5:51 am

1) Payment engine will be connected to Payment network using MQs (correct me if am wrong)

2) Technology that the Payment engine which we use is built on Java.

3) For the 3rd point I don’t know whether this is the correct one or not I have seen Virtual accounting concept for the Payment engine.

Rohit Kamath

June 6, 2021 at 6:18 am

1. Through MQ’s they connect with internal and external systems

2. Java

3. Custom filters to group the payments of similar kind. Alerts to the user

Santosh

June 6, 2021 at 9:53 am

Excellent

Pratik

June 6, 2021 at 7:59 am

1) Payment engine can be connected to payment network using either of MQ,Connect Direct, Swintnet File Act etc depending on Payment network.

2) Technology could be Mainframe,Java.

3) Blacklisted and whitelisted accounts to prevent fraud based on analytics.

Santosh

June 6, 2021 at 9:54 am

Interesting that you mentioned Mainframe. Are you talking about card systems ?

Pratik

July 8, 2021 at 8:29 am

Cards as well as inhouse payment system like HUB (HSBC universal banking system on maifnrame and AS400) by HSBC.

Aishwarya Kumar

June 7, 2021 at 6:36 am

Clearly articulated. Well done Santosh. Waiting for some more interesting articles

Roja Kanchalapati

June 16, 2021 at 4:08 pm

Very neat and clear explanation. Thanks…

ganesh

June 18, 2021 at 9:08 am

please elaborate end to end GPP sp or classic

Santosh

June 18, 2021 at 9:57 am

I have not worked in GPP so far

NAGARAJ SUSURLA RAMASUBBARAO

June 18, 2021 at 3:20 pm

Great Insights from you. Keep writing

Gaurao Pattewar

June 19, 2021 at 1:43 am

One more key function of PE is to provide feature to do pre and post enrichment of payment.very much applicable for outbound payments.

Santosh

June 19, 2021 at 4:41 am

I agree. Enrichment of data is an important part of payment processing to increase the STP rate. It was left out on purpose as the amount of enrichment and the way it is done widely varies. Your point is valid.

Sreeya

June 29, 2021 at 4:43 pm

This is a vey interesting article. Thank you so much for including this as well.

If possible, can you please provide a detailed architecture of a standard payment engine and how they integrate with external and internal applications?

Also, I have few queries and if you find time and answer these, it would be really helpful:

1. Would the first step be to identify the category the payment would fall to? – Incoming or Redirect or Outgoing or Book? Or is that done in the “Routing” step?

2. Where would the clearing identification happen? i.e,whether the outgoing has to go through DIrect Clearing or via a CSM or via a Intermediate Bank? This also happens in Routing? And are there any particular conditions to determine this?

3. Based on the clearing method determined, the accounting entries in the booking will take place, right? i.e whether the mirror nostro has to be credited or the mirror clearing etc? And will it happen directly or the appropriate suspense accounts will be credited and once the payment confirmation is received, the funds move from suspense to nostro or clearing accounts ?

4. Payment Engine connects directly to the appropriate networks or does it go via any other intermediary which would determine if it is a domestic or cross-border payment and then connect to the networks?

Santosh

June 29, 2021 at 4:55 pm

1. Would the first step be to identify the category the payment would fall to? – Incoming or Redirect or Outgoing or Book? Or is that done in the “Routing” step?

Santosh – It is defenitely identified at the initial stage. It one the payment engines that I have worked it is called pre-routing.

It is also important to note not all payment engines will have this kind of flow. It is just a sample to explain how payment processing will work. Different companies approach it differently.

2. Where would the clearing identification happen? i.e,whether the outgoing has to go through DIrect Clearing or via a CSM or via a Intermediate Bank? This also happens in Routing? And are there any particular conditions to determine this?

Santosh – This defenitely happens in routing . THis is called reachability check or exchange condition. The routing service we determine the payment’s path.

3. Based on the clearing method determined, the accounting entries in the booking will take place, right? i.e whether the mirror nostro has to be credited or the mirror clearing etc? And will it happen directly or the appropriate suspense accounts will be credited and once the payment confirmation is received, the funds move from suspense to nostro or clearing accounts ?

Santosh- You are spot on about the first question on accounting entries. Its based on clearing method. The use of suspense account widely varies from bank to bank. So there is no universal rule as such.

4. Payment Engine connects directly to the appropriate networks or does it go via any other intermediary which would determine if it is a domestic or cross-border payment and then connect to the networks?

Santosh – Payment engines post the messages directly to SWIFT or other local clearing.

In some banks there is a third part application that does this. All major payments engines can connect to SWIFT and local clearings directly.