Charges and FX

This article will attempt to understand how different charges are collected by the bank during payment processing. Charges are one of the ways banks make money, FX is another. Although FX is a huge topic by itself, we will try to understand it in the context of payment processing.

Charges

The first point to note is that the bank transfers will not have any associated charges. Only Customer transfers will have charges. Every bank will levy charges in different names, but we will add them all and identify them as ‘that bank’s charges‘ for simplicity.

Every country/region will have its own rules for charging the customer. We are going to discuss the most common charging methods. In the case of a simple credit transfer payment, both the ordering customer’s bank and beneficiary customer’s bank will have their charges. The question now is, who is going to bear the charges?

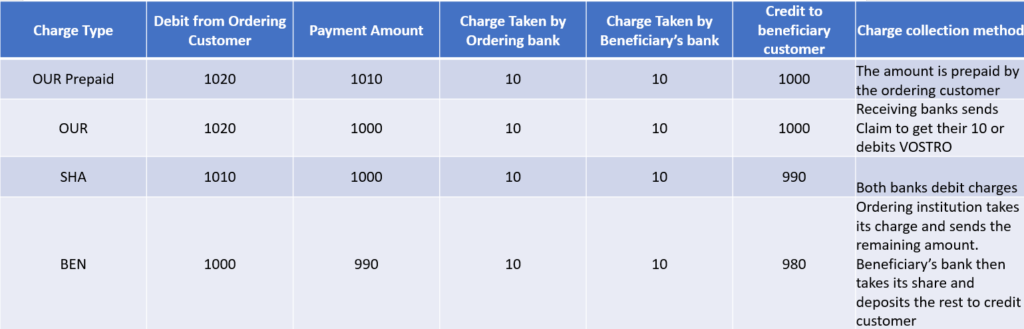

There are three types of charging methods:

- OUR/DEBT

- SHA/SHAR

- BEN/CRED

These charge methods are chosen by the ordering customer while initiating a payment. They will discuss with the beneficiary and agree upon the charge method. The payment message will contain the charge method and based on the method, banks will take charges during payment processing.

OUR/DEBT – In this case, both the ordering bank’s charges and beneficiary’s bank charges are to be paid by the ordering customer.

These are two types or OUR charges:

- Our Pre-Paid

- Our

OUR Pre-Paid: Here the ordering bank’s charges are taken by the ordering bank and the beneficiary’s bank (aka. Account with institution) charges are sent along with the payment amount. The beneficiary’s bank will take its charges and credit the rest of the amount to the beneficiary.

OUR: In this case, the beneficiary’s bank will process the payment without taking any charges and later send a claim payment to the ordering institution (Ordering customer’s bank). The ordering bank will take both its charges and the claim amount received from the ordering customer and send the beneficiary bank’s charges as a bank transfer.

There is a table with all the scenarios just below this section of the article. Kindly use that to further your understanding. It will make things much clearer.

SHA/SHAR: In this case, the ordering customer will pay the ordering bank’s fee and the beneficiary will pay the beneficiary’s bank charges. This is the most commonly used method.

BEN/CRED: This is the opposite of OUR/DEBT, where the ordering bank’s charges and the beneficiary’s bank charges are borne by the beneficiary customer.

Example : Transaction Amount $1000 – All amounts are in Dollars

FOREX(FX)

FOREX stands for FOReign EXchange. Every country will have its own currency which is called the home currency. All other currencies are foreign currencies. Not all currencies in the world have equal value.

Suppose you are given $1000 (USD) by your uncle who visits you from the US (Lucky you). If you want to buy stuff from the local grocery shop in India, they might not accept the foreign currency (FCY) USD so you have to convert it to INR which is the local currency (LCY). You now visit a money exchange and give them 1000 USD and to your surprise (If you have lived in a cave till now) you will get approx. 70000 INR. What this means is that the USD currency is stronger than INR which in turn means that 1 USD = 70 INR.

This is expressed as USD/INR = 70 where ’70’ is the exchange rate.

Coming back to the real world. In payments there are three currencies involved in a single transaction.

- Transaction Currency

- Debit Account Currency

- Credit Account Currency

FX will come into play if the transaction currency is not equal to the debit account’s currency or the credit account’s currency.

Example: A transaction is initiated in USD – $100 (Transaction currency) and the Debit account ccy (short for currency) is in INR and the credit account ccy is USD.

Here the debit account ccy is INR so the USD 100 has to be converted into INR and then it has to be debited. If we assume that the rate is 71 (USD/INR) then INR 7100 will be debited from the debit customer’s INR account.

What the bank is doing is that it’s buying INR from the debit customer and it sells USD. What’s in it for the bank? Banks will add margins to this exchange rate and that margins are profit for the banks. The bank will use the “sell rate”. What is a sell rate ??

Read a little further 😊 come on you can do it.

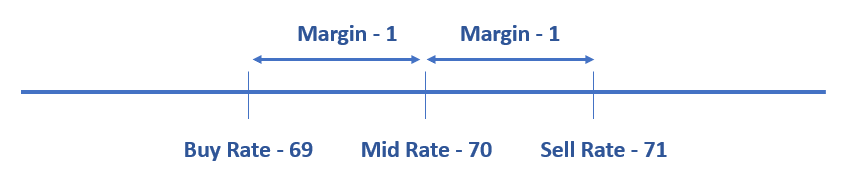

There are three types of rates:

- Buy Rate – Rate at which bank buys from you

- Sell Rate – Rate at which the bank sells you

- Mid-Rate – Average of Buy and Sell rate

For the USD/INR example

Remember Remember (like) the 5th of November. Banks always try to maximize their profit hence their mantra will be “buy low sell high”. When they buy from you it will be at a lower rate (Buy Rate) and when they sell you a currency it will, of course, be the Sell Rate. If you revisit the example from above they used the sell rate (71) as they sold USD to you. They debited INR 7100 from your account instead of INR 6900 (Buy rate). INR 100 is their profit (compared with Mid rate).

Some banks add additional margins to the buy and sell rates for certain customers in that case the buy and sell rate will move further away from mid-rate. Corporate customers who transact in millions get special discounts. FX has a lot of stuff other than this but for an introductory course, I think we can draw the line here.

Quiz:

- What are the different charges that you have seen banks take? In the context of payment processing

- What are direct and indirect quotations in FX?

Blog Comments

Dhyey Tanna

June 13, 2021 at 6:08 am

Question 1 :What are the different charges that you have seen banks take? In the context of payment processing.

Answer: I see that bank charges standard charges from their customers. Which mean charges are fix whatever the amount of transaction.

Question 2: What are direct and indirect quotations in FX?

Answer: Direct charges is like rate of foreign ccy as compared to local ccy. In this case base ccy is foreign ccy.

Example: USD to INR rate is direct charges rate. 0.7$ = 1 INR (if rate is 70)

And indirect Charges is like rate of local ccy in exchange of foreign ccy.

Example: INR to USD rate js indirect charges rate. 70INR = 1 USD.

(Answered this second question by taking help of Google- but it worth to check as i was not much aware about this term).

Santosh, let me know where i mistaken or add more where i answered short.

Santosh

June 13, 2021 at 8:44 am

Great effort. Simply put, If INR is the local currency

then USD/INR = 70 is direct quotation

and INR/USD = 0.01428 is indirect quotation

Bilash Sahu

June 13, 2021 at 6:41 am

Such a simplified explanation. Thanks buddy!

Santosh

June 13, 2021 at 8:26 am

Thanks, Bilash.

Manisha Singh

June 13, 2021 at 6:14 pm

It was worth reading, thanks for explaining about how the profits are earned by bank. Looking forward for more such articles. Keep it up Santosh.

Santosh

June 14, 2021 at 8:38 am

Thank you

NAGARAJ SUSURLA RAMASUBBARAO

June 18, 2021 at 3:14 pm

Well Written

Gaurav

July 2, 2021 at 3:03 pm

Very well captured.

QQ for Our-Prepaid scenario- >

Ordering customer debited with 1020

Transaction Amt = 1020

Ordering Bank charges =10

Bene Bank charges = 10

When is the ordering bank charges getting debited? if during Trns processing, shouldn’t the transaction amount = 1010 ?

I am assuming Transaction amount is what we are passing to Benebank, Please correct if I am missing on anything.

Santosh

July 2, 2021 at 5:29 pm

You Are absolutely correct .. It was a mistake .. Will correct it .. The transaction amount must be 1100

Shivangi Agrawal

July 25, 2021 at 2:59 pm

Really helpful, I was looking for such detailed description of FX, thanks for sharing

Santosh

July 25, 2021 at 4:16 pm

Thanks

Shatanik Roy Chowdhury

December 9, 2021 at 5:00 pm

Hi Santosh ,

Would be helpful if you can publish some insightful contents on CBPR + and HVPS + programs of ISO20022 transformation initiative .

Where I am sure will be beneficial for many of us in clarifying the intent ,purpose and scope of the above two programs along with understanding the differences between FMI’s vs PMI’s .

Keep doing this great job of enlightening us !

Thanks

Shatanik