Introduction

Since the inception of the European Union and the introduction of the EURO currency, there was a big gap as far as payments were concerned. There wasn’t a unified payment method or framework for the unified market. SEPA was created to resolve this problem in the year 2008.

What is SEPA? Single Euro Payments Area is a payment scheme introduced by the European Union to simplify and harmonize payment transactions in EURO. Remember!! SEPA payment can only be done in EURO. Let us understand this through an example. If you are someone living in Germany and want to send 10000 Eur to your friend in Norway then you would send this payment Via SEPA.

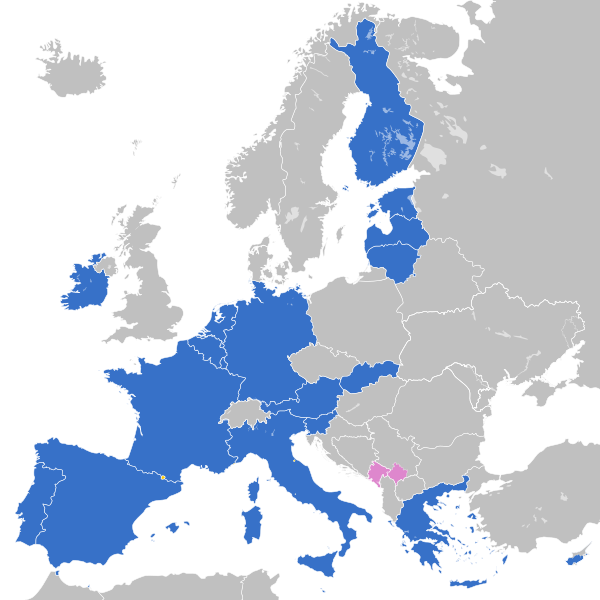

Usually, books start with the history of the topic in hand. Let us start with Geography and create history(see what I did there ? 🙂 ). When I was trying to understand SEPA I was not able to clearly distinguish between the key entities mentioned below and it is very important to understand these as it will provide a really good bird’s eye view of where SEPA stands.

- Europe

- European Union (EU)

- European Economic Area (EEA)

- European Free Trade Association (EFTA)

- Eurozone

- SEPA

Europe – It’s a continent that we are familiar with. It is a geographical area with close to 50 states in it. SEPA is implemented in this region but not all countries in Europe are a part of SEPA and an example of such a country is Ukraine.

European Union (EU) – It is a political and economic union of 27 states that are located in Europe. Not all the countries in Europe are part of the European Union. An example of this is Switzerland. All the members of the EU participate in SEPA.

European Economic Area (EEA) – This is an agreement between the European Union (EU) and 3 members of the European Free Trade Association (EFTA). It consists of 30 states and all of them are a part of SEPA. Switzerland is not a part of the EEA.

European Free Trade Association (EFTA) – It is a trade organization that consists of 4 states Iceland, Liechtenstein, Norway, and Switzerland. Three of these states are a part of EEA. All 4 states are part of Europe and SEPA. Switzerland here is an exception. They are not part of EEA but are part of SEPA.

Eurozone – These are EU states which have adopted Euro(€) as their home currency. There are a total of 19 states as of today. The European central bank is the central bank of the Eurozone. All of them are part of SEPA.

SEPA – Finally, the SEPA area consists of 27 EU states, 4 EFTA states, and 4 microstates with a monetary agreement with the EU and UK, which has exited the EU. There are some additional territories as well that are part of SEPA. The total count of states and territories is 52 that are part of SEPA. An example of an autonomous state is Åland Islands which is counted as a separate territory.

If your head is spinning at this point then don’t worry, I am there with you. After collecting all these details, I was walking upside down 😊 but it was worth it. It provided a lot of clarity for me as well.

Countries that participate in the SEPA payments scheme can exchange messages freely across borders in Euro. It is important to note that not all states have Euro as their home currencies.

I wanted to keep this article a short one as it is stuffed with a lot of information. I have listed below some of the things that you can expect from this series (and more)

- The governing bodies

- Payments schemes

- Clearing and Settlement mechanisms (country wise)

- Payment messages overview

- Payment Flows for the different schemes

- Features of SEPA

- In depth analysis of the payment messages

- Payment timelines

- And more

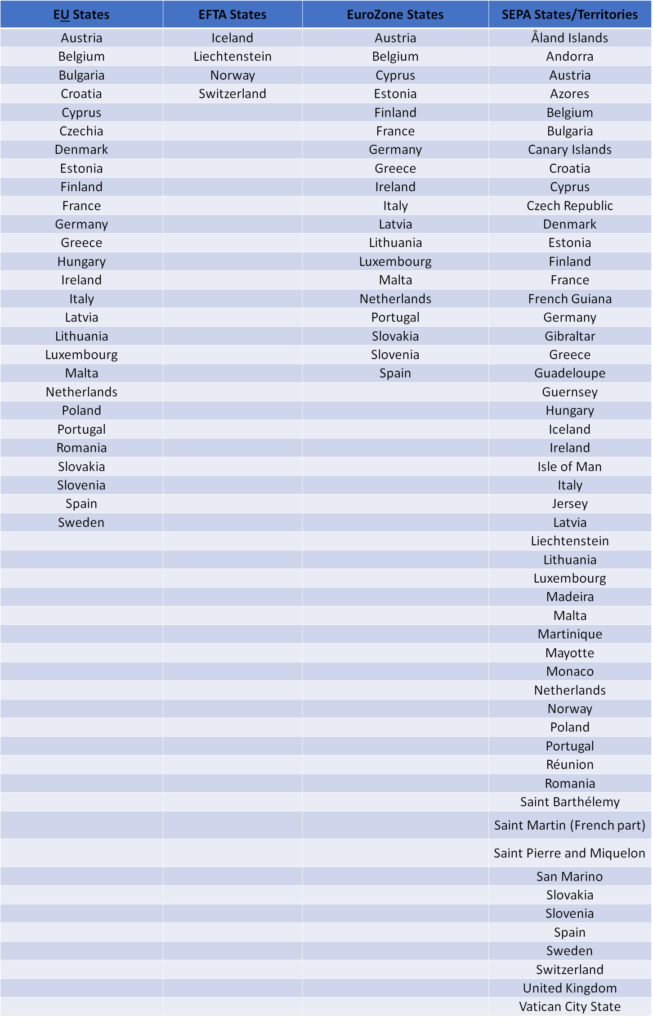

Countries List: (If you need a copy of this in excel format pls reach out to me)

Blog Comments

Neeraj Kumar

June 26, 2021 at 3:01 pm

I read SEPA theory from many different sources but never saw SEPA article started with Geography of SEPA.

Amazing approach of SEPA introduction. Today only I got clarity about EEA, Eurozone, European Union. Good Start.

Santosh

June 26, 2021 at 5:45 pm

THank you

Srinjoy

June 29, 2021 at 5:14 pm

Excellent, it cleared a lot of my doubts

Santosh

June 29, 2021 at 6:12 pm

Thank you

Pooja yadav

June 27, 2021 at 10:26 am

Great initiative to make us understand from basics

Santosh

June 27, 2021 at 3:57 pm

Thank you

Rekha

June 27, 2021 at 7:04 pm

Great information, first time gor such a good information and it’s easy to understand thank you for sharing.

Santosh

June 28, 2021 at 11:11 am

Thank you

Amey

June 28, 2021 at 11:01 am

Great 👍

Santosh

June 28, 2021 at 11:10 am

Thanks

Srinidhi

June 28, 2021 at 11:06 am

Hi Santhosh,

the information present on your site is very helpful for me as I’m also in the payments domain.

It will be more needful if you put some contents related to FEDWIRE payments too.

Santosh

June 28, 2021 at 11:10 am

Sure. I will try to in future articles.

Manisha

June 28, 2021 at 4:33 pm

Would like to go through for all payments article written by you can help with the message details triggered in SEPA.

Santosh

June 28, 2021 at 5:29 pm

Coming soon

Vitthal

June 29, 2021 at 4:26 am

Very informative. Nice initiative Santosh !!!

Santosh

June 29, 2021 at 4:47 pm

Thank you

Ashesh Deb

June 30, 2021 at 2:24 am

Excellent Article, Though I had worked on SEPA. don’t recall coming across any such well visualized simply explained article on Geographical extent of SEPA.

Looking forward to rest of the series.

Santosh

June 30, 2021 at 2:09 pm

THank you so much

Seema

June 30, 2021 at 6:46 pm

Thank you for sharing..

Santosh

July 1, 2021 at 10:14 am

Welcome

Ritika

July 2, 2021 at 4:36 pm

Very explanatory.

Santosh

July 2, 2021 at 5:26 pm

Thanks

Rohit Nilawar

August 18, 2021 at 10:10 am

Hi Santosh ,

Thanks for sharing this information in simple language, it helps us a lot to clear all our concepts and understood the topic in easy manner.

, please suggest and same to give understanding on SWIFT also

Santosh

August 18, 2021 at 1:42 pm

Next topic is SWIFT