Domestic Payment Schemes in the UK – By Pradyumna Acharya

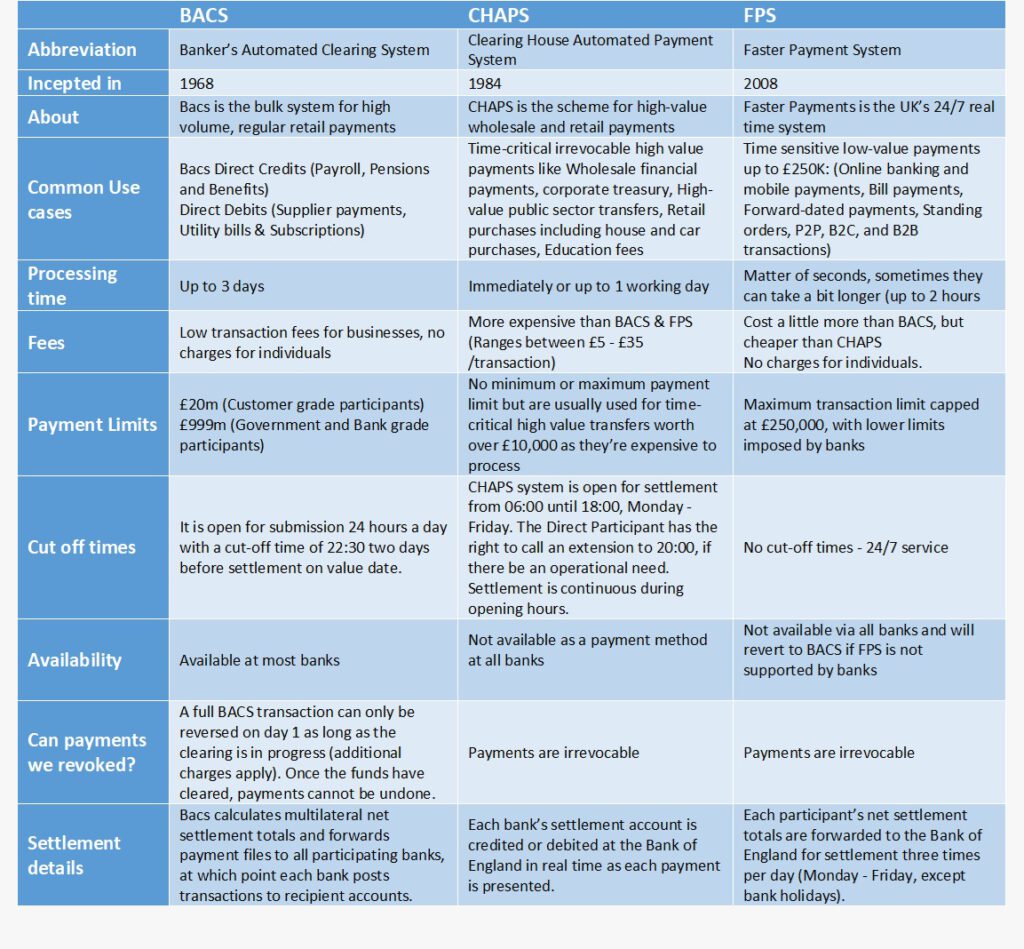

Let’s now take a quick look at the three payment schemes: BACS, CHAPS, and FPS.

BACS

Bacs is the bulk system for high volume, regular retail payments

What it is and what it does

- Bacs is the UK’s bulk payment system

- It is used for credit transfers and Direct Debits

- The system settles on a multilateral net basis

- Payments are submitted two days prior to the value date

Use cases

- Regular, scheduled B2B and B2C payments are sent via Bacs

- Bacs Direct Credits (Payroll, Pensions and Benefits)

- Direct Debits (Supplier payments, Utility bills, Subscriptions)

Operational details

Bacs is the bulk system for high volume, regular retail payments. Bacs Payment Schemes Ltd. (Bacs) sets the rules for the system. It is open for submission 24 hours a day with a cut-off time of 22:30 two days before settlement on value date. Bacs calculates multilateral net settlement totals and forwards payment files to all participating banks, at which point each bank posts transactions to recipient accounts. Posting and settlement occur at the same time on the same day; two days after payments are submitted.

CHAPS

CHAPS is the UK’s Real Time Gross Settlement scheme used for critical, high-value real-time payments

What it is and what it does?

- CHAPS is the scheme for high-value wholesale and retail payments

- CHAPS Payments are settled individually intraday in central bank funds

- It is chosen for critical payments

- Participants can choose urgent payments (in real-time) or non-urgent same-day payments

Use cases

- Time-critical irrevocable high value payments are sent via CHAPS

- Wholesale financial payments

- Corporate treasury

- Commercial business and financial transactions of all values

- High-value public sector transfers

- Retail purchases including house and car purchases

- Education fees

Operational details The CHAPS system is open for settlement from 06:00 until 18:00, Monday – Friday. The Direct Participant has the right to call an extension to 20:00 should there be an operational need. Settlement is continuous during opening hours. Participants can choose to make urgent payments, which settle immediately, or non-urgent payments, which benefit from optimized liquidity management. Each bank’s settlement account is credited or debited at the Bank of England in real-time as each payment is presented. The Bank of England sends confirmation of settlement to each participating bank. Processing between Direct Participants is governed by the scheme.

Faster Payments

Faster Payments is the UK’s 24/7 real-time system

What it is and what it does?

- FPS is a functionally rich, real time system, 24/7

- Real time confirmation to sender, and immediate funds availability

- It supports three types of credit transfers:

- Single immediate payments, forward dated payments and standing order payments

Use cases

FPS is used for time-sensitive low-value payments up to £250K:

- Online banking and mobile payments

- Bill payments

- Forward dated payments

- Standing orders (recurring payments)

- P2P, B2C, B2B transaction

Operational details

The Faster Payments Service (FPS) is the UK’s low-value real-time system The rules for the system are set by Faster Payments Scheme Ltd. Posting occurs in near real-time. For some indirect participants, however, posting is slower. Each participant’s net settlement totals are forwarded to the Bank of England for settlement three times per day (Monday – Friday, except bank holidays).

Leave a Comment